Beacon Economics - World Economic Report

This month, AfricasheW320 features a world economic report from Beacon Economics. Chris Thornberg, founder of Beacon Economics, presented during the plenary session at the 7th ACA Annual Conference in Benin, where he discussed cashew in a global economic setting. Beacon's Newsletter contribution, which will be featured again in June, highlights Africa's place in the global economy while also focusing on import and export trends for agricultural commodities.

Africa’s regional economy performed better than global trends in 2011, but Africa’s trade with major economies in 2012 suggests slower Gross Domestic Product (GDP) growth.

-

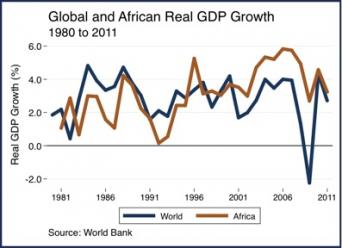

Although end-of-year 2012 GDP Actuals are not yet available from the World Bank, African GDP grew by 3.2% in 2011, which was slightly faster than global GDP growth of 2.7%. In 2011 however, African GDP growth slowed compared to 2010, when it was 4.6%.

-

According to the African Development Bank’s 2012 Economic Outlook, Africa's slower GDP growth in 2011 was a result of political conflicts in North Africa. For example, 2011 GDP growth for Egypt, the second largest economy in Africa, was 1.8%, which was significantly slower than Egypt’s 5.2% annual growth in 2010.

-

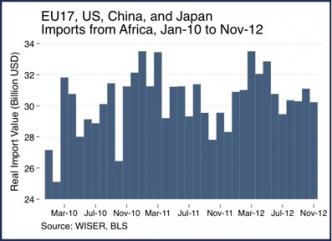

Recent trade activity with major world economies suggests that African GDP growth may be slower in 2012 than in 2011. African GDP growth is highly dependent on global exports, which account for approximately 30% of the continent's GDP.

-

In real terms, the latest data on EU17, US, China, and Japan imports from Africa point to lower African export growth in 2012 than in 2011. Using the US Bureau of Labor Statistics Import Price Index to adjust for inflation,

2012 year-to-date EU17, US, China, and Japan imports from Africa are up 1.5% from the prior year-to-date period in 2011, but appear to be slowing from 2011, when annual growth was 3.9%.

-

The US has been the largest drag on African exports in 2012. Real US imports from Africa were down 28% year-to-date in 2012. The bulk of these declines were concentrated in crude oil imports. EU17, China, and Japan all reported positive real growth in imports from Africa year-to-date.

Slow GDP growth continues among major world economies in 2012 and 2013.

-

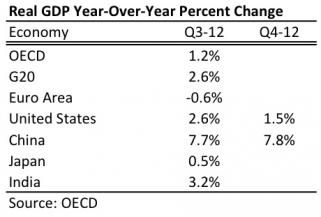

Real global GDP grew by 2.7% from 2010 to 2011, which is markedly slower than the 4.3% real growth rate from 2009 to 2010. Through the third quarter of 2012, country-specific data suggests that the slowdown in the world economy has continued.

-

The EU17 economy continues to exhibit the largest drag on the global economy. For the first three quarters of 2012, the EU17 experienced negative year-over-year GDP growth. After a November 2012 forecast of 0.1% growth for 2013, the European Commission recently issued a revision that forecasts that the EU17 economy will contract by 0.3% in 2013.

-

Japan’s economy continues to stagnate. Japan posted 0.5% year-over-year growth in the third quarter of 2012.

-

Although real US fourth-quarter 2012 growth fell to 1.5% year-over-year versus 2.6% in the third quarter, much of this decline is attributable to pullbacks in defense spending due to budget uncertainties that surrounded the “Fiscal Cliff” negotiations in the US Congress.

-

If implemented, the US federal spending cuts known as “sequestration” would adversely impact US GDP in the first half of 2013. Beacon Economics forecasts that the proposed spending cuts would trim approximately 1% off of annual US GDP in 2013.

-

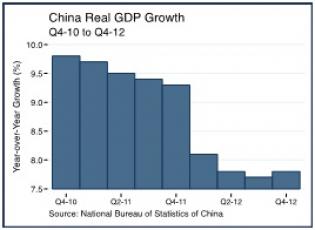

In the fourth quarter of 2012, Chinese year-over-year real GDP growth accelerated to 7.8% versus 7.7% in the third quarter. It is only one quarter of data showing a marginal increase, but it does mark China’s first quarter of accelerating GDP growth in several years.

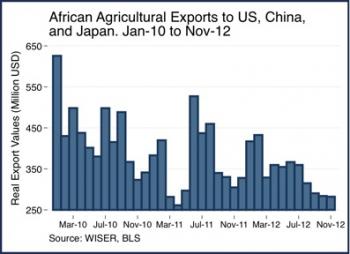

As of November 2012, year-to-date real growth in African agricultural exports to the US, China, and Japan had declined annually.

-

After adjusting for inflation using the US Bureau of Labor Statistics import/export price indices for agricultural commodities, real African agricultural exports to the US, China, and Japan were down 6.2% year-to-date (YTD) through November 2012 versus the same YTD period in 2011. In 2011 African agricultural exports to US, China, and Japan accounted for 12% of total African agricultural exports.

-

The big question mark for total African agricultural export growth in 2012 and 2013 will be the Euro Area market, which is the leading destination for African agricultural products (47% of total African agricultural exports in 2011). Actuals for 2012 Euro Area agricultural trade data with Africa are not yet available, but as mentioned the European recession is dragging on the global economy. A decline in trade flows with the Euro Area combined with lower exports to US, China, and Japan would point to low to negative real growth for African agricultural exports in 2012.

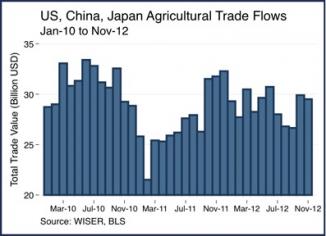

However as of November 2012, real global trade of agricultural commodities had grown annually among major exporters and importers.

-

After adjusting for inflation we see that agricultural trade among the US, China, and Japan and the rest of the world increased 7.4% in 2012 YTD after declining by 11.9% annually in 2011.

-

In real terms, most major economies have seen positive growth in exports and imports of agricultural products with the US, China, and Japan. These trade flows account for approximately 30% of world agricultural trade.

-

If trends continue, the increasing global agricultural trade with the US, China and Japan should drive economic growth in struggling regions like the Euro Area in 2013, which would ultimately also benefit African exports to the Euro Area.